In Singapore, all beverages are subject to an excise duty based on the alcohol content. While Odoo can manage the sales, purchase, and inventory, it is not able to handle this duty out-of-the-box.

However, with some smart configuration and a little customisation Odoo can help businesses track accurately their inventory, with and without duty.

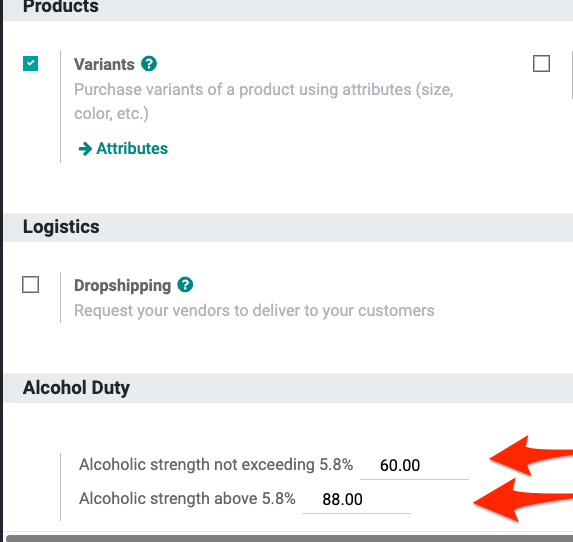

Using Variants to manage the goods

First we can consider that an sku with alcohol actually comes in two variants: with duty paid, and without duty paid. Odoo is able to manage quantity of variants (like shirts that come in several colours).

Converting stock without duty to stock with duty

The second step is to have a mechanism to convert a sku item without-duty, into the variant with duty-paid. This is done by doing a double stock adjustment: a decrease the quantity of variant duty-unpaid, and an increase the quantity of variant duty-paid. Because this step can be error-prone, a customised screen can be used to guide the selection of the goods and to automate the operation.

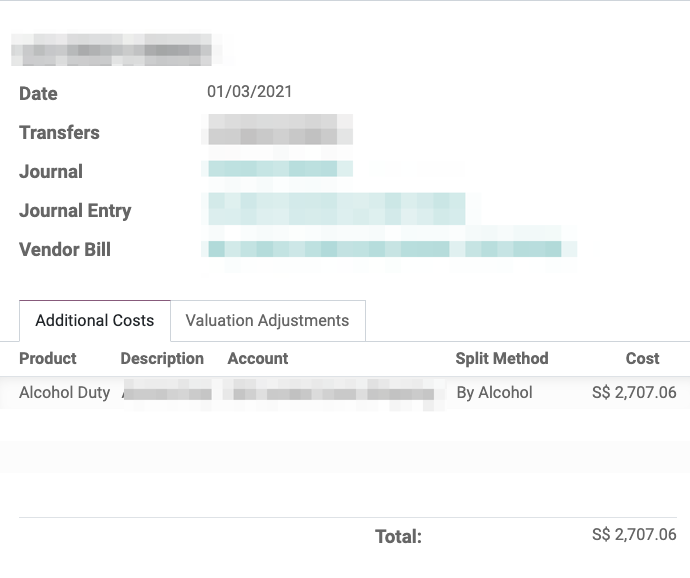

Inventory Valuation

Finally, for accounting purpose, we need to update the inventory value; and this is done by adding a landed cost representing the excise duty.

The rest is handle by Odoo standard Purchase, Sale, Inventory and accounting modules.

End Results

So at the end of the configuration/customisation, we have:

a warehouse that represents the goods without custom duties

a warehouse with the goods where the duties have been paid

We can track for each product, the quantity with and without duties

The inventory value is accurate, with the duties incorporated in the stock value

Interested in improving your management of stock ?

Contact us to get more information